oklahoma franchise tax instructions

File the annual franchise tax using the same period and due date of their corporate income tax filing year or File the annual franchise tax on the Oklahoma Corporate Income Tax Form 512 or 512-S. Get and Sign Income and Franchise Tax Forms and Instructions Oklahoma 2021-2022.

Irs Installment Agreement Chicago Il 60647 Mm Financial Consulting Inc Chicago Internal Revenue Service Lettering

To register your account with OkTAP you will need the following information.

. Tax year the tax will be due and payable on May 1st of each year and delinquent if not paid on or before June 1st. If filing a consolidated franchise tax return for oklahoma the oklahoma franchise tax for each corporation is computed separately. Lets say you own a cute little diner in tulsa that earns 500000 each year.

These are the steps business owners must take in order to file their franchise tax return. Once completed you can sign your fillable form or send for signing. Use a oklahoma form 200 2021 template to make your document workflow more streamlined.

Complete Form 512-FT Computation of Oklahoma Consolidated Annual Franchise Tax to determine the combined taxable income to report on page 2 Section Two lines 1825. Oklahomas Department of Commerce has a list of Business Licensing and Operating Requirements organized by industry. If filing a Consolidated Franchise Tax Return for Oklahoma the Oklahoma franchise tax for each corporation is computed separately and then combined for one total tax.

These elections must be made by July 1. Complete Form 512-FT Computation of Oklahoma Consolidated Annual Franchise Tax to determine the combined taxable income to report on page 2 Section Two lines 1825. Late payments of franchise tax 100 of the franchise tax liability must be paid with the extension.

To make this election file Form 200-F. Oklahoma franchise tax instructions. You may file this form online or download it at taxokgov.

All forms are printable and downloadable. Applications for refunds must include copies of your related Oklahoma Income Tax Returns. Item C Place the beginning and ending reporting period MMDD.

Franchise Tax Payment Options New Business Information New Business Workshop Forming a Business in Oklahoma Streamlined Sales Tax Forms Publications Forms - Business Taxes Forms - Income Tax Publications. If you wish to make an election to change your filing frequency or to file using the Oklahoma Corporate Income Tax Form 512 or 512-S complete OTC Form 200-F. The franchise excise tax is levied and assessed at the rate of 125 per 1000 or fraction thereof on the amount of capital used in-vested or employed in Oklahoma.

You can create an account by clicking Register here To file your Annual Franchise Tax by Mail. Income and Franchise Tax Forms and Instructions Oklahoma 2021-2022. But Oklahoma does have laws regulating the sale or offering of business opportunities under the Oklahoma Business Opportunity Sales Act Okla.

Oklahoma is classified as a non-registration state because it has no laws requiring franchisors to register with the state before offering or selling their franchise. Oklahoma Annual Franchise Tax Return Instruction Sheet Form 203-A instructions Revised May 1999. You must also disclose the value of.

Paper returns with a 2-D barcode should be mailed to the Oklahoma Tax Commission PO. When submitting the Franchise Tax Return foreign corporations must pay a 100 registered agensts fee. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return.

Mail Form 504-C Application for Extension of Time to File an Oklahoma Income Tax Return for Corporations Partner-ships and Fiduciaries with. If you are the Master logon and have cancelled your own online access you will need to contact the Oklahoma Tax Commission Help Desk at 405521-3160 to have your online access reinstated. Prepare and file your balance sheet and Schedules B C D of your annual return.

Enter your username and password. Complete the Oklahoma Annual Franchise Tax Return Item A Place the taxpayer FEIN in Block A. Acquired by the nature of all organizations falling within the purview of the Franchise Tax Code.

Maximum filers should complete and file Form 200 including a schedule of current If a taxpayer computes the. If filing a stand-alone OklahomaAnnual Franchise Tax Return Form 200 do not use this form to remit franchise tax. Return due date is January 1 2008 or later - If your capital was 200000 or less the minimum tax is zero.

Item B Enter the Account number issued by the Oklahoma Tax Commission beginning with FRX followed by ten digits. The amount must be either zero 0 or the Line 2 Registered Agent Fee If your corporation originated in a state other than Oklahoma the Secretary of State of Oklahoma charges an annual registered agent fee of 10000. Paper returns without a 2-D barcode should be mailed to the Oklahoma Tax Commission PO Box 26800 Oklahoma City OK 73126-0800.

On the Oklahoma Tax Commission website go to the Business Forms page. Complete Form 512-FT Computation of Oklahoma Consolidated Annual Franchise Tax to determine the combined taxable income to report on page 2 Section Two lines 1825. Ad Download Or Email OK Form 200 More Fillable Forms Register and Subscribe Now.

Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual. Specific Line Instructions Line 1 Tax Enter the amount computed from your worksheet. To file your Annual Franchise Tax Online.

If filing a Consolidated Franchise Tax Return for Oklahoma the Oklahoma franchise tax for each corporation is computed separately and then combined for one total tax. Form 200-F must be filed. Use Fill to complete blank online STATE OF OKLAHOMA OK pdf forms for free.

Prepare and file your Oklahoma Annual Franchise Tax. Rural Electric Co-Op License. The remittance of estimated franchise tax must be made on a tentative estimated franchise tax return Form 200.

Fill Online Printable Fillable Blank 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State of Oklahoma Form. Oklahoma must file an annual franchise tax return and pay the franchise tax by july 1 of each year. Go to the Oklahoma Taxpayer Access Point OkTAP login page.

What is Oklahomas Franchise Tax. The use of the correct corporate name and. If no number has been issued leave blank.

71 801 et seq. If filing a Consolidated Franchise Tax Return for Oklahoma the Oklahoma franchise tax for each corporation is computed separately and then combined for one total tax. Oklahoma Annual Franchise Tax.

Mine the amount of franchise tax due.

Form 200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Where S My Refund How To Track Your Tax Refund 2022 Money

Tax Day 2022 Deadline To File Is Monday What To Know If You Need An Extension

2015 Oklahoma Resident Individual Income Tax Forms And Instructions Forms Ok Gov Oklahoma Digital Prairie Documents Images And Information

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Pin By Ca Gulshan Sharma On Legal Services Goods And Service Tax Legal Services Registration

Turbodebitcard Intuit Com Turbo Debit Card Activate Visa Debit Card Debit Debit Card

Solved Oklahoma Nonresident Tax Return Ok 511 Nr Intuit Accountants Community

Godzilla Monster S Inc By Roflo Felorez Deviantart Com On Deviantart Godzilla Godzilla Funny Godzilla Comics

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

Form 1040 U S Individual Tax Return Definition

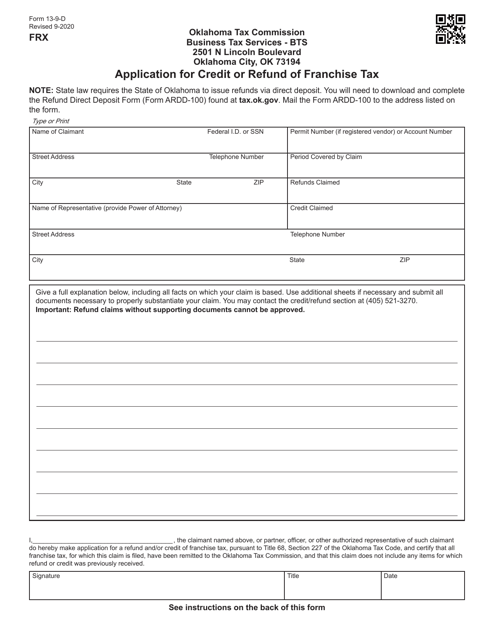

Form 13 9 D Download Fillable Pdf Or Fill Online Application For Credit Or Refund Of Franchise Tax Oklahoma Templateroller

California Tax Forms H R Block

What Is A 1120 Tax Form Facts And Filing Tips For Small Businesses