change in working capital formula dcf

Imagine if Exxon borrowed an additional 20 billion in long-term debt boosting the current. Cash on hand varies for different companies but having.

Change In Net Working Capital Nwc Formula And Calculator

Net Working Capital NWC Definition.

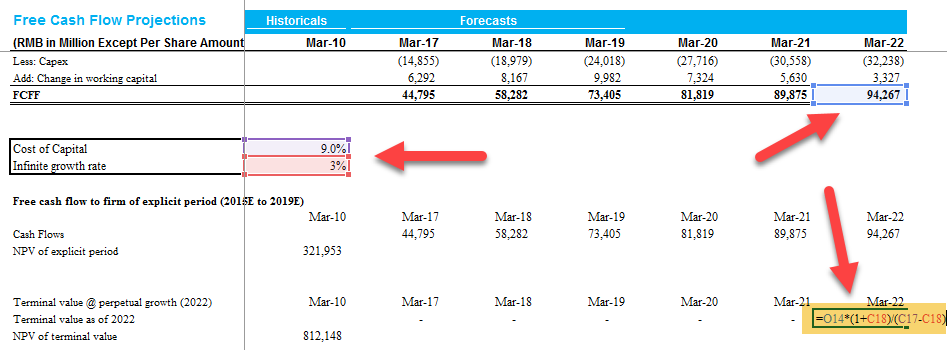

. 3 statement model DCF model MA model LBO model budget model. PV 956 1 10341. An increase in working capital implies that more cash is invested in working capital and thus reduces cash flows.

For most companies you analyze by using the change in working capital in this way the FCF calculation and owner earnings calculation is similar as it was for Amazon and Microsoft. Difference between Working Capital and Changes in Working Capital. When you use the lower number for changes in working capital and then compute the net present value the result is consistent with the true theoretical number.

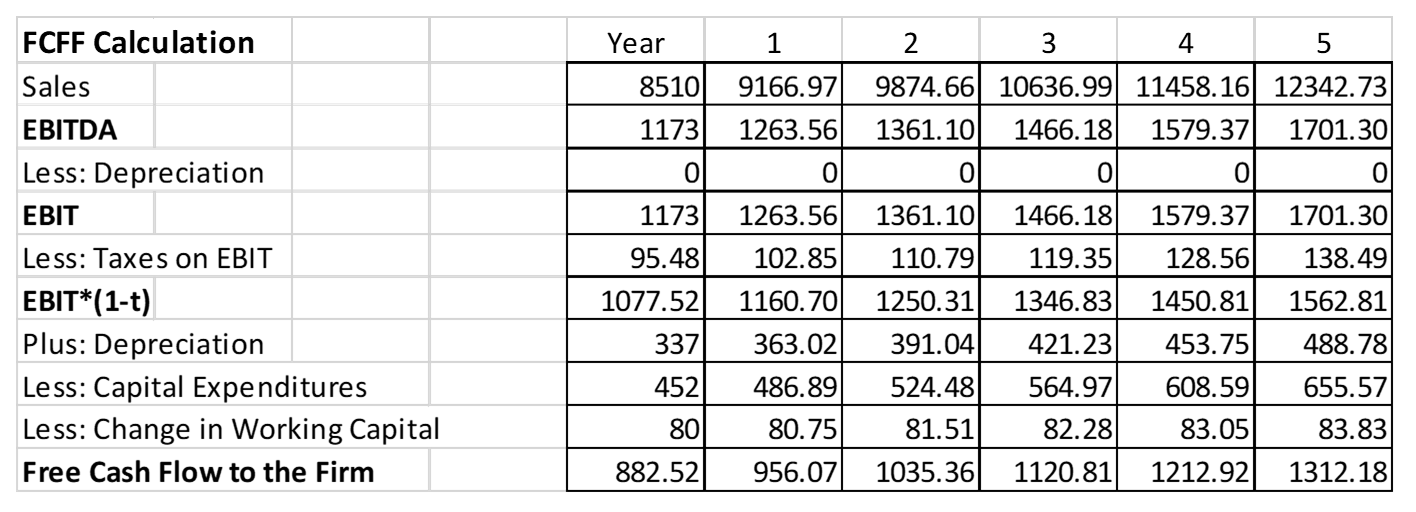

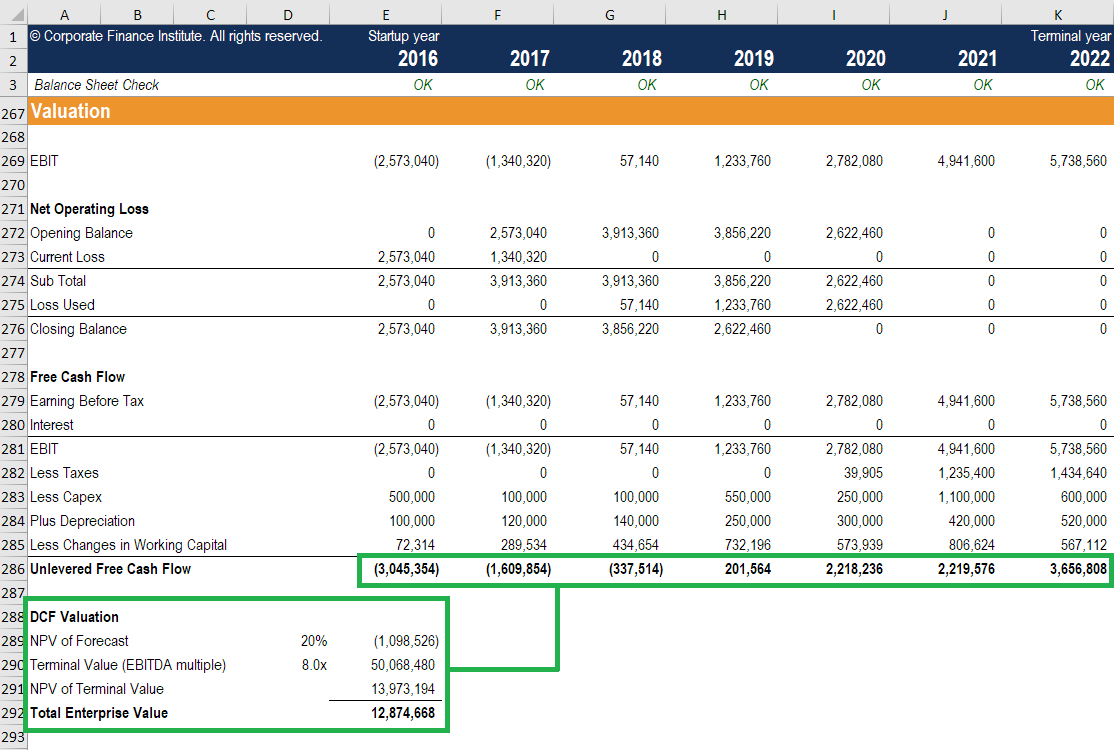

Change in Net Working Capital 12000 7000. Changes in working capital -2223. FCFF 1WACC 1 for year 1 2 for year two and so on up to year 5.

You include change in cash as a part of change in overall working capital. Now that we have the free cash flow figured we could find the present value of those cash flows the formula for that process is below. If we calculate terminal value based on a year of high growth we are assuming the level of capital expenditure and working capital investment required to support the high growth will also remain at the same level perpetually which is definitely not the case when the growth rate drops to 3 at 93 growth changes in working capital is 118k.

Change in Working Capital Summary. If a company stock piles a ton of cash you can treat some of it as excess cash and tack it back on after youve completed the entire DCF valuation. Changes in working capital is an idea that lives in the cash flow statement.

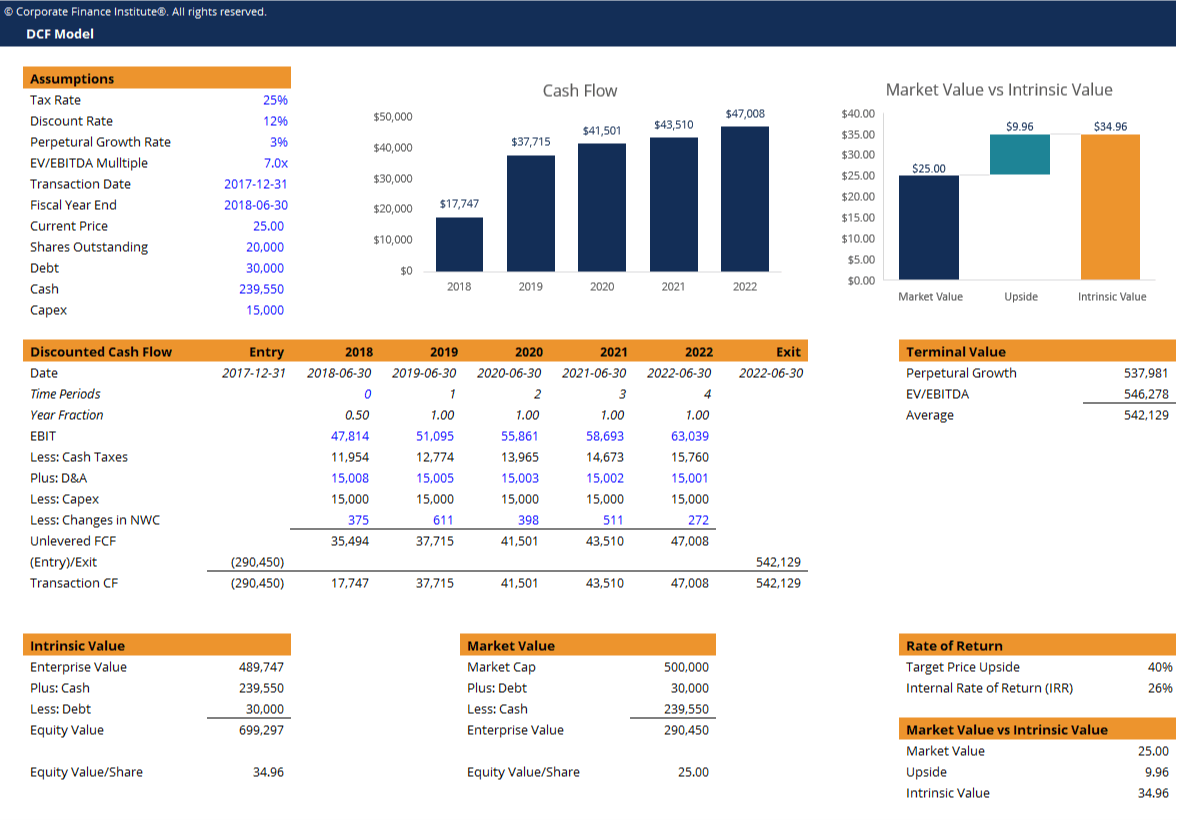

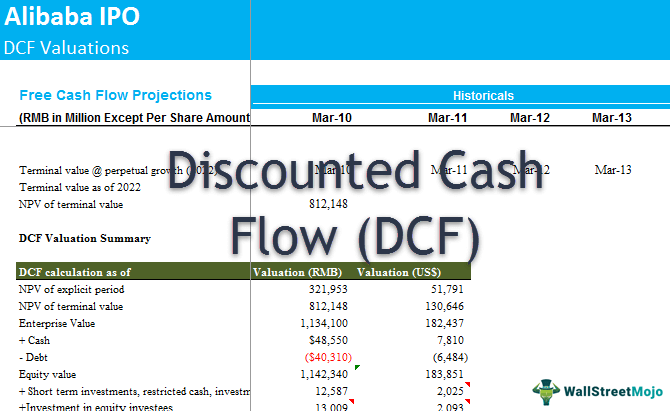

You can obtain the non-cash working capital as a percent of revenues by looking at the firms history or at industry standards. Discounted cash flow DCF is a valuation method used to estimate the value of an investment based on its expected future cash flows. Free Cash Flows are simply the Extra Cash Flows that a company could make use of after paying for all its liabilities and expenses.

Owner Earnings 8903 14577 5129 13312 2223 13084. And Change in Net Working Capital is an integral part to arrive at the value of Free Cash Flow which is used in valuation and financial modelling. PV 95607 110341.

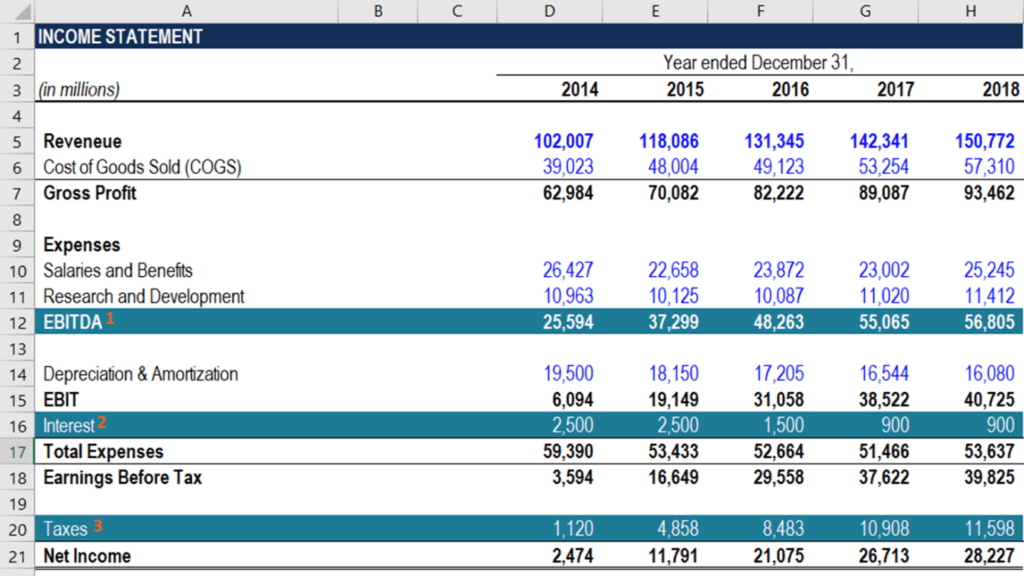

FCF EBIT1-Tax Rate Depreciation and Amortization Capital Expenditures Increases in Net Working Capital NWC If you have an increase in net working capital you have more current assets than liabilities than you did in the previous period. In-depth Explanation of Working Capital. All in One Financial Analyst Bundle 250 Courses 40 Projects 250 Online Courses.

In other words non-cash working capital is priority over normal net working capital when it comes to evaluating a company based on DCF. The net working capital metric is a measure of liquidity that helps determine whether a company can pay off its current liabilities with its current assets on hand. Change in a Net Working Capital Change in Current Assets Current Assets Current assets refer to those short-term assets which can be efficiently utilized for business operations sold for immediate cash or liquidated within a year.

As a general rule the more current assets a company has on its balance sheet in relation to its current liabilities the lower its liquidity risk and the better off itll be. Its defined this way on the Cash Flow Statement because Working Capital is a Net Asset and when an Asset increases the company. On the Cash Flow Statement the Change in Working Capital is defined as Old Working Capital New Working Capital where Working Capital Current Operational Assets Current Operational Liabilities.

It is a measure of a companys short-term liquidity and is important for performing financial analysis financial modeling What is Financial Modeling Financial modeling is performed in Excel to forecast a companys. Guide To Change in Net Working Capital. Common Drivers Used for Net Working Capital Accounts.

Discover the top 10 types to forecast NWC. NPV and DCF. Remember that working capital current assets current liabilities.

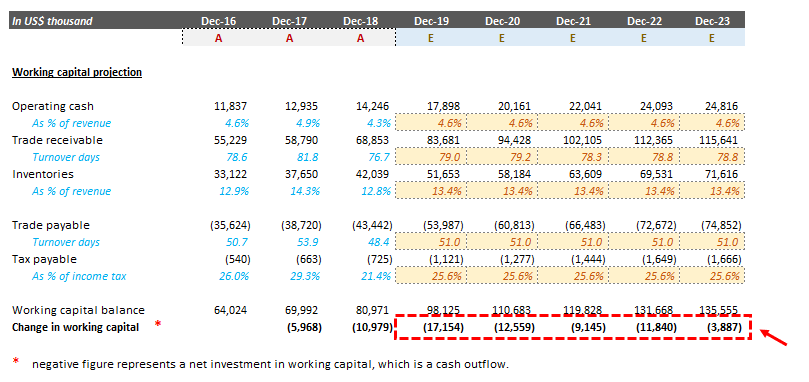

Under ordinary operating conditions many if not most companies have positive working capital current assets exceed current liabilities so forecasted increases in revenues require additional working capital investments and free cash flow is reduced all else held constant. Working capital is a balance sheet definition that only gives us a value at a certain point in time. Working capital increases.

As mentioned above and you might know Net Working Capital enables analysts and investors to gauge where a company is positioning. The discount rate refers to the interest rate used in discounted cash flow DCF analysis to determine the present value of future cash flows. File with a little more detail.

The working capital formula tells us the short-term liquid assets available after short-term liabilities have been paid off. There would be no change in working capital but operating cash flow would decrease by 3 billion. Accounts Receivables Accounting Our Accounting guides and.

The change in net working capital formula is given as N E B where E is ending net working capital and B is beginning NWC. So current assets have increased. It still counts as cash that is tied into running the day to day operations of the business.

You can easily calculate the Net Working Capital using Formula in the template. In this case the change in working capital is computed using the formula above and it is dramatically less. Heres the formula for free cash flows Ill be referring to.

Since the change in net working capital has increased it means that change in current assets is more than a change in current liabilities. Free cash flow decreases. How do you project changes in net working capital NWC when building your DCF and calculating free cash flow.

It means that the company has spent money to purchase those assets. If youre calculating change in working capital for the purpose of a DCF or. Some people argue that free cash flow is not a good metric and that only taxes should be added back to get a cash number.

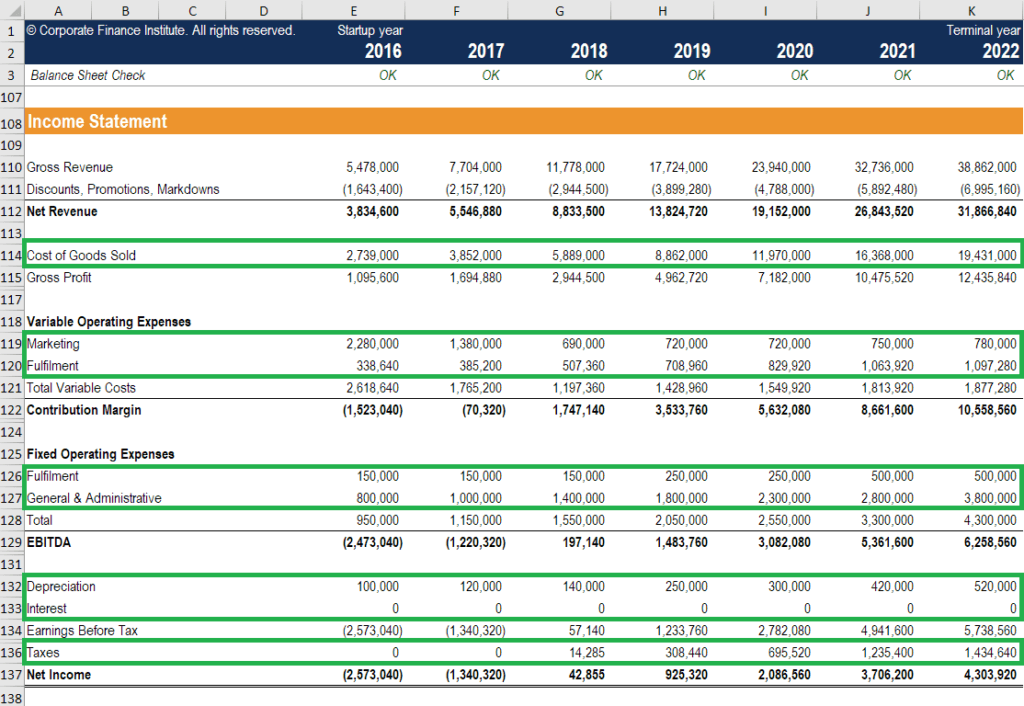

Answer 1 of 3. Change in Net Working Capital 5000. Below is a list of assumptions that are used in a financial model Types of Financial Models The most common types of financial models include.

Under this method the expected future cash flows are projected up to the life of the business or asset in question and the said cash flows are discounted by a. An example of the first year is as follows. Now with the changes in business activities the level of Working Capital also changes it means.

Changes in Net Working Capital Working Capital Current Year Working Capital Previous Year Or. In this video I cover the different ratios tha. Does change in working capital include cash.

Discounted Cash Flow DCF formula is an Income-based valuation approach and helps in determining the fair value of a business or security by discounting the future expected cash flows. The non-cash working capital as a percent of revenues can be used in conjunction with expected revenue changes each period to estimate projected changes in non-cash working capital over time. The screenshots below illustrate the same type.

Discounted Cash Flow Create Dcf Valuation Model 7 Steps

Dcf Formula Calculate Fair Value Using Discounted Cash Flow Formula

Projecting Net Working Capital For Free Cash Flow Calculation Dcf Model Insights Youtube

Discounted Cash Flow Analysis Street Of Walls

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

How To Calculate Fcfe From Ebitda Overview Formula Example

Change In Working Capital Video Tutorial W Excel Download

Explaining The Dcf Valuation Model With A Simple Example

Change In Net Working Capital Nwc Formula And Calculator

Airlines Discounted Cash Flow 40 Dcf 41 Valuation Model In 2021 Cash Flow Statement Cash Flow Profit And Loss Statement

Dcf Model Training The Ultimate Free Guide To Dcf Models

Change In Working Capital Video Tutorial W Excel Download

Free Cash Flow Fcf Most Important Metric In Finance Valuation

Discounted Cash Flow Analysis Veristrat Llc What S Your Valuation

Dcf Model Tutorial With Free Excel Business Valuation Net

Discounted Cash Flow Create Dcf Valuation Model 7 Steps

Dcf Model Training The Ultimate Free Guide To Dcf Models

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance